The recent turmoil surrounding the $20 trillion carry trade in Japan is creating a significant stir in global financial markets. Here’s a breakdown of what this means and its potential impacts.

Understanding the Carry Trade

The carry trade is a financial strategy where investors borrow money in a currency with low interest rates (like the Japanese yen) and invest it in assets denominated in currencies with higher interest rates. This practice aims to profit from the interest rate differential.

Why Japan?

Japan has been a focal point for carry trades due to its historically low interest rates. Investors have been borrowing yen at minimal costs and using these funds to invest in higher-yielding assets globally. The scale of these trades has grown to a staggering $20 trillion, highlighting the immense reliance on Japan’s low borrowing costs.

What Happened?

Recent developments have shaken this strategy. Key factors include:

Interest Rate Shifts: Bank of Japan (BOJ) has exited its ultra-loose monetary policy and for the first time since 2008 ended the negative rate policy, which means that the differential that made the carry trade profitable is shrinking. Higher interest rates in Japan would increase borrowing costs, making the carry trade less attractive and potentially unprofitable.

Currency Fluctuations: The yen’s appreciation against other currencies could significantly increase the cost of repaying yen-denominated loans, leading to potential losses for investors when they convert their investments back to yen.

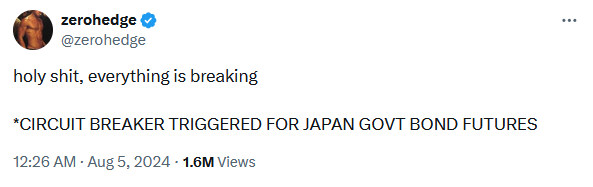

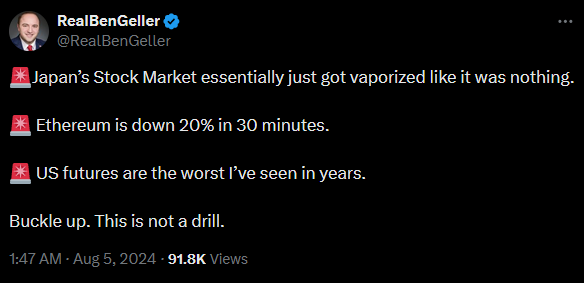

Market Volatility: Economic uncertainties and geopolitical tensions such as the conflict in the Middle EAst can lead to sudden and unpredictable market conditions, further disrupting carry trades. The recent volatility in bond markets has already had a substantial impact, but can Japan maneuver itself out of this crisis? The answer will depend on how BOJ deals with this situation. A likely round of quantitative easing maybe on the cards but for how long?

Implications of the Blow-Up

The unraveling of the carry trade in Japan has several significant consequences:

- Increased Market Volatility: As investors unwind their positions, financial markets will experience heightened volatility. This will lead to sharp movements in currency, bond, and equity markets. In fact this is what we are seeing right now and as the day progresses and markets open, expect a cascading reaction.

- Investor Sentiment: A blow-up of such a widespread strategy can erode investor confidence. Will this trigger a 2008 like crash? Too early to call it. So stay tuned folks!

The Bigger Picture

This disruption in Japan’s carry trade underscores the interconnectedness of global financial markets. It serves as a stark reminder that even long-standing and seemingly foolproof investment strategies can unravel quickly under changing economic conditions.

A point to reflect here.

As always, investors must remain vigilant and adaptable to navigate the ever-shifting landscape of global finance.